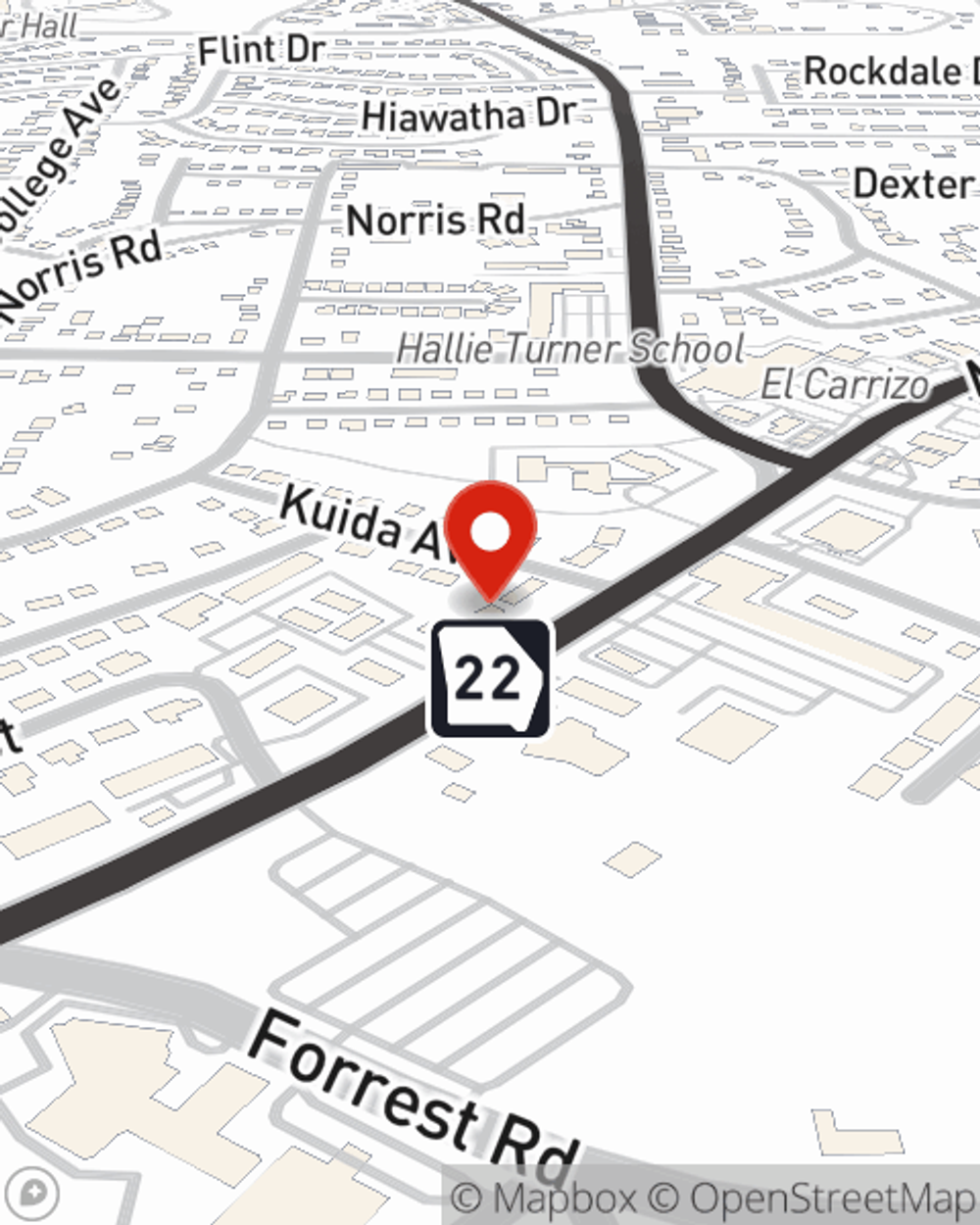

Business Insurance in and around Columbus

One of the top small business insurance companies in Columbus, and beyond.

Helping insure businesses can be the neighborly thing to do

- Columbus, GA

- Harris County, GA

- Fort Moore, GA

- LaGrange, GA

- Phenix City, AL

- Opelika, AL

- Salem, AL

- Auburn, AL

- Oxford, MS

- Buena Vista, GA

- Lumpkin, GA

- Box Springs, GA

- Talbotton, GA

- Smiths Station, AL

- Cusseta, GA

- Hamilton, GA

- Pine Mountain, GA

- Valley, AL

- West Point, GA

- Lanett, AL

- Seale, AL

- Ladonia, AL

- Dadeville, AL

- Tallapoosa County

Business Insurance At A Great Price!

Running a business is about more than making a profit. It’s a lifestyle and a way of life. It's a vision for a bright future for you and for those you love. Because you give every effort to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with business continuity plans, worker's compensation for your employees and a surety or fidelity bond.

One of the top small business insurance companies in Columbus, and beyond.

Helping insure businesses can be the neighborly thing to do

Small Business Insurance You Can Count On

Whether you own a barber shop, a cosmetic store or a toy store, State Farm is here to help. Aside from exceptional service all around, you can personalize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

Contact agent Connie Wilkes to review your small business coverage options today.

Simple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Connie Wilkes

State Farm® Insurance AgentSimple Insights®

Steps to start a small business

Steps to start a small business

Starting a small business can be exciting and challenging. Use this guide to help turn your idea into a successful business.

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.